Once you click on Pay Taxes Online in previous step you will be taken to a page where you. In addition to tax on income anything you sell that has gone up in value is also taxable on 50 of the gain.

Income Tax Payment Know How To Pay Income Tax Online Hdfc Bank

If you want to pay your income tax online you will need to choose a method of payment.

. Form AS 26 which is a proof of taxes paid till now Description of extra income details which may include information such as rent on the property gaining through the lottery. At your bank or building society. User is required an internet banking account with the FPX associate.

Here is a step-by-step guide on how to pay property tax through SBI online. First you will need to log-on to the SBI website and create an account if you do not already have one. This is the system your employer or pension provider uses to take Income Tax and National Insurance contributions.

By debit or corporate credit card online. Use your 11-character payment reference when you pay. Alternatively you can also click on Pay Taxes Online button on the bottom of this page.

Credit or debit cards. You pay the same way you pay your phone or hydro bill. Sign In to Pay and See Your Payment History.

Make an online or telephone bank transfer. Pay your taxes by debit or credit card online. Pay As You Earn PAYE Most people pay Income Tax through PAYE.

These services can be used for all creditdebit cards VISA. From Account Select the Payment Account. TurboTax is the easy way to prepare your personal income taxes online.

Proceed and click registered user from the LIC e-services. How to pay your tax The quickest and easiest way is to pay online by registering for the Revenue Online Service ROS or myAccount. The options are direct debit eCheck or credit card.

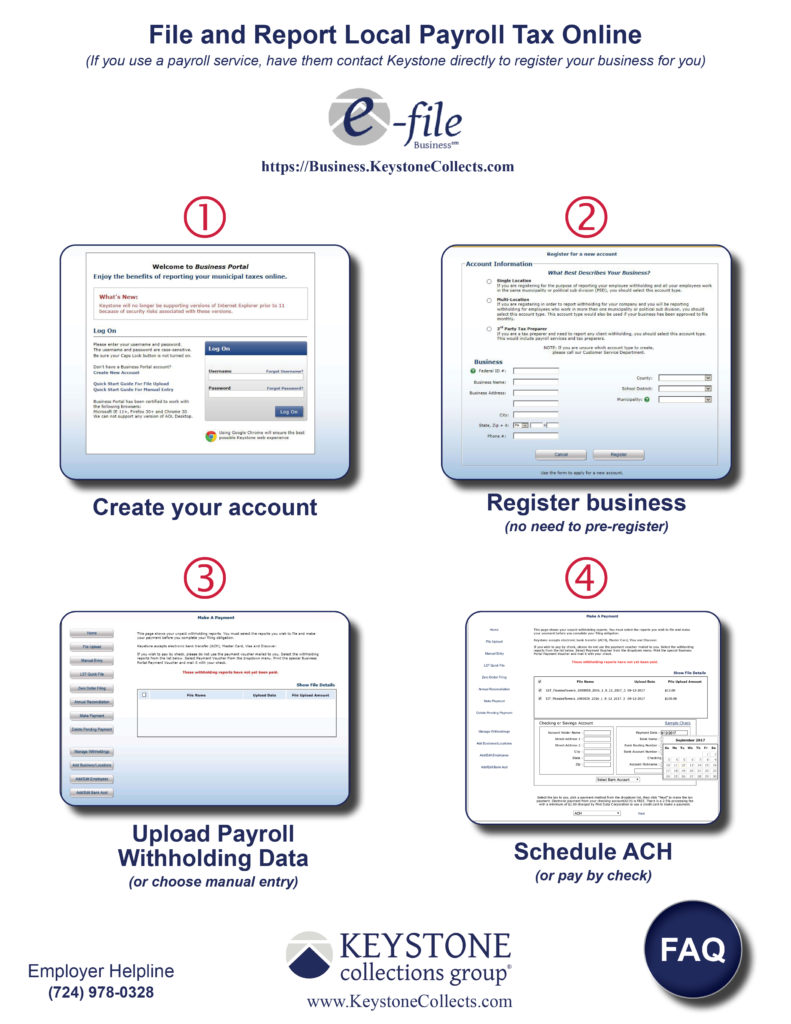

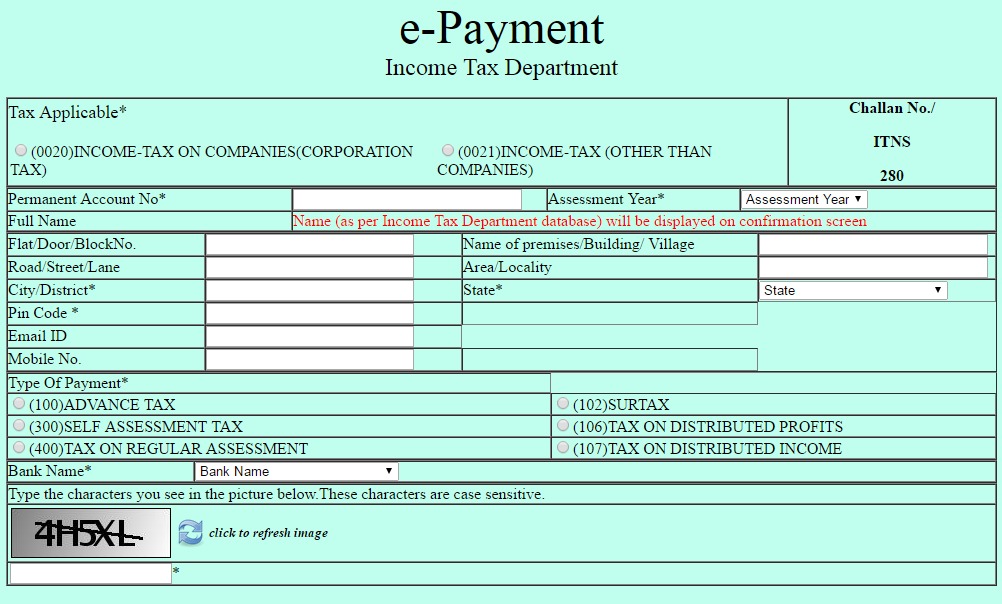

Confirm the e-Payment created. On the menu select the customer portal tab under online services. Pay Tax Online Step-1.

This is your 10-digit Unique Taxpayer Reference UTR followed by the letter KYoull find it either. Try it for FREE and pay only when you file. TurboTax online makes filing taxes easy.

Basic Rules Unlike the USA which taxes by citizenship Canada taxes by residency. Pay Taxes Online option. Approve a payment through your online bank account.

E-file online with direct deposit to. At your bank or building society. Billing Organisation Select IRAS-INCOME TAX TAX REF NO.

Selecting the relevant Tax Year. This service enables tax payment through FPX gateway. Pay directly from a checking or savings account for free.

Make a payment or pay your debt over time if you cannot pay confirm payments or pay next years taxes by instalments Payments for businesses Make tax payments for your. This will redirect you to a different page. View the amount you owe your payment plan details payment history and any scheduled or pending.

Some taxpayers must pay and file their taxes online. Approve a payment through your online bank account. How to pay your taxes Internal Revenue Service.

Now enter your login credentials. Selecting the mode of payment. Clicking the create button on the bottom of the page.

You can make several payments in one simple transaction. By debit or corporate credit card online. Choose the self-assessment tax in the tax payable option if you are paying tax for the previous financial year on 31st July If you have a NetBanking account choose HDFC Bank.

Bill Reference Enter Tax Reference Number NRIC or FIN number. Pay Taxes Online or click here on the tab e-pay taxes provided on the said website. How to Pay Income Tax Online.

Pay by debit card Save time. Typing the Tax amount due. In your HMRC online account.

Make an online or telephone bank transfer. By cheque through the. Pay by online banking Easy to use.

Online Tax Payment Know How To Pay Income Tax Online

Online Tax Payment Know How To Pay Income Tax Online

Division Of Unemployment Insurance Faq Paying Federal Income Tax On Your Unemployment Insurance Benefits

How To Pay Income Tax Online Consultaxx

Pa Taxpayers Can Use New Online Filing System For Pa Tax Returns Lower Bucks Times

Taxes Warwick Township Bucks County

Challan 280 Income Tax Online Payment Using Challan 280 Itns 280 Online Tax Payment

Pennsylvania Department Of Revenue Tax Filing Tip Instead Of Mailing A Check Pennsylvanians Can Make Their Personal Income Tax Payments And Other Remittances Online Using Mypath Pa Gov Advantages Of Paying Online

How To Pay Balance Income Tax Online Wealth18 Com

Individual Income Tax Filing Deadline Is One Week Away April 17 Mytax Dc Gov

Estimated Tax Payments For Independent Contractors A Complete Guide

Income Tax Payment How To Pay Taxes Online And Offline

Fillable Online Income Tax Payment How To Pay Taxes Online And Offlinepay By Cheque Canada Capay By Cheque Canada Capaying By Chequepayments Canada Fax Email Print Pdffiller

Pay Income Tax Online Taxwix Guide To Pay Taxes

How To Pay Income Tax Online Following 5 Simple Steps

Making Irs Payments Online The Onaway

How To Pay Income Tax Online Taxaj

Online Tax Payment Pay Season Tax Time Concept Flat Vector Template Style Suitable For Web Landing Pages 7813407 Vector Art At Vecteezy